NCERT Solutions for Class 10 Economics Chapter 3 Money and Credit मुद्रा और साख

Important Questions for Class 10 Economics Chapter 3 Money and Credit

Thank you for reading this post, don't forget to subscribe!Page No. 40 Let’s Work These Out

Question 1:

How does the use of money make it easier to exchange things?

मुद्रा के प्रयोग से वस्तुओं के विनिमय में सहूलियत कैसे आती है?

Answer

The use of money makes it easier to exchange things because

(1) it is accepted as a medium of exchange.

(2) it serves as a unit of value.

(3) it solves the problem of double coincidence of wants.

मुद्रा के प्रयोग से वस्तुओं के विनिमय में सहूलियत आती है क्योंकि

(1) इसे विनिमय के माध्यम के रूप में स्वीकार किया जाता है।

(2) यह मूल्य की इकाई के रूप में कार्य करता है।

(3) यह आवश्यकताओं के दोहरे संयोग की समस्या का समाधान करता है।

Question 2:

Can you think of some examples of goods / services being exchanged or wages being paid through barter?

क्या आप कुछ ऐसे उदाहरण सोच सकते है, जहाँ वस्तुओं तथा सेवाओं का विनिमय या मजदूरी की अदायगी वस्तु विनिमय के जरिय हो रही है?

Answer

In rural areas, usually foograins are exchanged for other crops in some cases. In even some government schemes, labourers are paid not in cash but in kind, e.g., 5 kg of wheat per day of work.

ग्रामीण क्षेत्रों में, आमतौर पर कुछ मामलों में अनाज का आदान-प्रदान अन्य फसलों के लिए किया जाता है। यहाँ तक कि कुछ सरकारी योजनाओं में भी, मजदूरों को नकद नहीं, बल्कि वस्तु के रूप में भुगतान किया जाता है, जैसे, काम के प्रति दिन 5 किलो गेहूँ।

Page No. 42 Let’s Work These Out

Question 1:

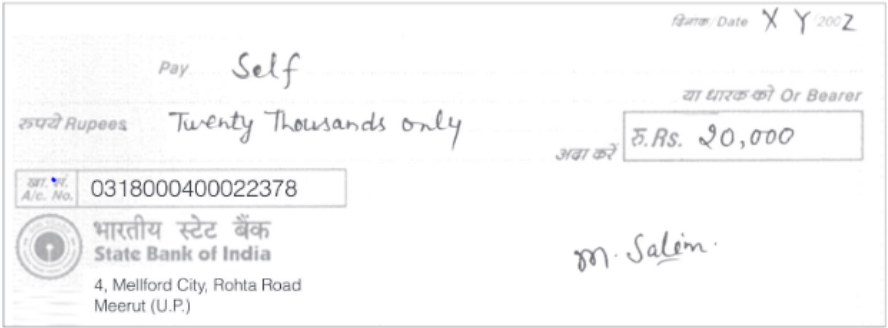

M. Salim wants to withdraw Rs 20,000 in cash for making payments. How would he write a cheque to withdraw money?

एम. सलीम भुगतान के लिए 20,000 रु. नकद निकालना चाहते हैं। इसके लिए वह चेक कैसे लिखेंगे?

Answer

Question 2:

Tick the correct answer.

After the transaction between Salim and Prem,

(i) Salim’s balance in his bank account increases, and Prem’s balance increases.

(ii) Salim’s balance in his bank account decreases and Prem’s balance increases.

(iii) Salim’s balance in his bank account increases and Prem’s balance decreases.

सही उत्तर पर निशान लगाएँ –

(अ) सलीम और प्रेम के बीच लेन–देन के बाद

(क) सलीम के बैंक खाते में शेष बढ़ जाता है और प्रेम के बैंक खाते में शेष बढ़ जाता है।

(ख) सलीम के बैंक खाते में शेष घट जाता है और प्रेम के बैंक खाते में शेष बढ़ जाता है।

(ग) सलीम के बैंक खाते में शेष बढ़ जाता है और प्रेम के बैंक खाते में शेष घट जाता है।

Answer

(iii) Salim’s balance in his bank account increases and Prem’s balance decreases.

(ग) सलीम के बैंक खाते में शेष बढ़ जाता है और प्रेम के बैंक खाते में शेष घट जाता है।

Question 3:

Why are demand deposits considered as money?

माँग जमा को मुद्रा क्यों समझा जाता है?

Answer

Demand deposits are considered as money, because they can be withdrawn when required and the money withdrawn can be used for making payments. So, they are also considered as money in the modern economy.

माँग जमा को मुद्रा समझाजाता है, क्योंकि आवश्यकता पड़ने पर इन्हें निकाला जा सकता है और निकाले गए धन का उपयोग भुगतान के लिए किया जा सकता है। इसलिए, आधुनिक अर्थव्यवस्था में इन्हें भी मुद्रा माना जाता है।

Page No. 45 Let’s Work These Out

Question 1:

Why do lenders ask for collateral while lending?

उधारदाता उधार देते समय समर्थक ऋणाधार की माँग क्यों करता है?

Answer

Lenders ask for collateral while lending because if payment of interest and repayment of the principal are not made on time, as the last resort the lenders can sell the collateral assets and recover their money.

उधारदाता उधार देते समय समर्थक ऋणाधार की मांग करते हैं, क्योंकि यदि ब्याज का भुगतान और मूलधन की चुकौती समय पर नहीं की जाती है, तो अंतिम उपाय के रूप में उधारदाता समर्थक ऋणाधार परिसंपत्तियों को बेचकर अपना पैसा वसूल कर सकते हैं।

Question 2:

Given that a large number of people in our country are poor, does it in any way affect their capacity to borrow?

हमारे देश की एक बहुत बड़ी आबादी निर्धन है। क्या यह उनके कर्ज़ लेने की क्षमता को प्रभावित करती है?

Answer

Poor have low capacity to borrow since they have no collateral to offer. As such, they cannot get any credit from formal sources of credit like banks and co-operatives. They mostly take loans from informal sources of credit like money lenders, friends, relatives, etc.

निर्धनों की कर्ज लेने की क्षमता कम होती है क्योंकि उनके पास देने के लिए कोई ज़मानत नहीं होती। इसलिए, उन्हें बैंकों और सहकारी समितियों जैसे औपचारिक ऋण स्रोतों से कोई ऋण नहीं मिल पाता। वे ज़्यादातर साहूकारों, दोस्तों, रिश्तेदारों आदि जैसे अनौपचारिक ऋण स्रोतों से ऋण लेते हैं।

Question 3:

Fill in the blanks choosing the correct option from the brackets.

While taking a loan, borrowers look for easy terms of credit. This means _____(low/high) interest rate, ______ (easy/tough) conditions for repayment, _____ (less/more) collateral and documentation requirements.

कोष्ठक में दिए गए सही विकल्पों का चयन कर रिक्त स्थानों की पूर्ति करें –

ऋण लेते समय कर्जदार आसान ऋण शर्तों को देखता है। इसका अर्थ है _____ (निम्न/उच्च) ब्याज दर, ______ (आसानी/कठिन) अदायगी की शर्तें, _______ (कम/अधिक) समर्थक ऋणाधार एवं आवश्यक कागजात।

Answer

low, easy, less.

निम्न, आसानी, कम

Page No. 47 Let’s Work These Out

Question 1:

List the various sources of credit in Sonpur.

सोनपुर में ऋण के विभिन्न स्रोतों की सूची बनाइए।

Answer

Various sources of credit in village Sonpur are

(i) Village moneylender

(ii) Traders

(iii) Landowner as moneylender

(iv) Commercial banks

(v) Krishak co-operative society

सोनपुर गाँव में ऋण के विभिन्न स्रोत हैं

(i) ग्राम साहूकार

(ii) व्यापारी

(iii) साहूकार के रूप में भूस्वामी

(iv) वाणिज्यिक बैंक

(v) कृषक सहकारी समिति

Question 2:

Underline the various uses of credit in Sonpur in the above passages.

ऊपर दिए हुए अंशों में ऋण के विविध प्रकारों वाली पंक्तियों को रेखांकित कीजिए।

Answer

Question 3:

Compare the terms of credit for the small farmer, the medium farmer and the landless agricultural worker in Sonpur.

सोनपुर के छोटे किसान, मध्यम किसान और भूमिहीन कृषक मजदूर के लिए ऋण की शर्तों की तुलना कीजिए।

Answer

(a) Terms of credit for small farmer

• High rate of interest.

• Promise to sell crops to traders at low prices as repayment of loan.

(b) Terms of credit for medium farmer.

• They can take loans from banks or from co-operatives who charge very low rate of interest.

• Loan can be paid back in the next three years.

(c) Landless agricultural workers in Sonpur

• Borrower has no means to repay the loan in cash. So, he pledges to repay loans by working for the landowner

• Rate of interest is high.

(क) छोटे किसानों के लिए ऋण की शर्तें

• ब्याज की ऊँची दर।

• ऋण चुकाने के लिए व्यापारियों को कम दामों पर फसल बेचने का वादा।

(ख) मध्यम किसानों के लिए ऋण की शर्तें।

• वे बैंकों या सहकारी समितियों से ऋण ले सकते हैं जो बहुत कम ब्याज दर लेते हैं।

• ऋण अगले तीन वर्षों में चुकाया जा सकता है।

(ग) सोनपुर में भूमिहीन कृषक मजदूर ऋण की शर्तें।

• उधारकर्ता के पास नकद में ऋण चुकाने का कोई साधन नहीं है। इसलिए, वह ज़मींदार के लिए काम करके ऋण चुकाने का वचन देता है।

• ब्याज दर ऊँची है।

Question 4:

Why will Arun have a higher income from cultivation compared to Shyamal?

श्यामलाल की तुलना में अरुण को खेती से ज्यादा आय क्यों होगी?

Answer

Arun gets a loan from the commercial bank at a rate of interest 8.5% per annum, while Shyamal gets loans from a village moneylender al an interest rate of 5% per month (i.e., 60% per annum). Arun has the capacity to pay bank loans as compared to Shyamal and gets a fresh loan in next three years. Like Shyamal he is not bound to sell his produce to the moneylenders who give a low price. He can sell his produce at market rates.

अरुण को वाणिज्यिक बैंक से 8.5% वार्षिक ब्याज दर पर ऋण मिलता है, जबकि श्यामल को गाँव के एक साहूकार से 5% मासिक ब्याज दर (अर्थात 60% वार्षिक) पर ऋण मिलता है। श्यामल की तुलना में अरुण में बैंक ऋण चुकाने की क्षमता है और उसे अगले तीन वर्षों में एक नया ऋण मिल जाता है। श्यामल की तरह, उसे अपनी उपज कम कीमत वाले साहूकारों को बेचने की बाध्यता नहीं है। वह अपनी उपज बाज़ार भाव पर बेच सकता है।

Question 5:

Can everyone in Sonpur get credit at a cheap rate? Who are the people who can?

क्या सोनपुर के सभी लोग को सस्ती ब्याज दरों पर कर्जा मिल सकता है? किन लोगों को मिल सकता है?

Answer

Everyone cannot get credit at a cheep rate. Only the following people are able to get it

• Who have some collateral.

• Who have organised themselves into co-operative society.

• Who can fulfil the banks documentation requirements.

हर किसी को सस्ती दर पर ऋण नहीं मिल सकता। केवल निम्नलिखित लोग ही इसे प्राप्त कर सकते हैं:

• जिनके पास कुछ समर्थक ऋणाधार हो।

• जिन्होंने खुद को सहकारी समिति के रूप में संगठित किया हो।

• जो बैंक की दस्तावेज़ आवश्यकताओं को पूरा कर सकते हों।

Question 6:

Tick the correct answer.

(i) Over the years, Rama’s debt

· will rise.

· will remain constant.

· will decline.

(ii) Arun is one of the few people in Sonpur to take a bank loan because

· other people in the village prefer to borrow from the moneylenders.

· banks demand collateral which everyone cannot provide.

· interest rate on bank loans is same as the interest rate charged by the traders.

सही उत्तर पर निशान लगाइए—

(क) समय के साथ, ऋण का ऋण

बहुत बढ़ेगा

कम होगा

समाप्त रहेगा

(ख) अलग सोनपुर के उन लोगों में से हैं जिन्हें ऋण उधार लेते हैं क्योंकि—

• गाँव के अन्य व्यक्ति उन पर निर्भर करते हैं।

• उनके पास कोई दो समर्थक ऋणाधार नहीं है।

• छोटे किसान काफी मात्रा में बुआई के लिए पैसे की कमी पर नहीं रहते।

• भूमिहीन मजदूर ज्यादा लागत से जितना कमा पाते हैं।

Answer

(i)(a) will rise. बहुत बढ़ेगा

(ii)(b) banks demand collateral which everyone cannot provide. उनके पास कोई दो समर्थक ऋणाधार नहीं है।

Question 7:

Talk to some people to find out the credit arrangements that exist in your area. Record your conversation. Note the differences in the terms of credit across people.

कुछ लोगों से बातचीत कीजिए, जिनसे आपको अपने क्षेत्र में ऋण प्रबंधों के बारे में कोई जानकारी मिले। अपनी बातचीत को रिकॉर्ड कीजिए। विभिन्न लोगों में ऋण की शर्तों में विभिन्नता को लिखिए।

Answer

Do it yourself

स्वयं करे।

Page No. 50 Let’s Work These Out

Question 1:

What are the differences between formal and informal sources of credit?

Question 2:

Why should credit at reasonable rates be available for all?

Question 3:

Should there be a supervisor, such as the Reserve Bank of India, that looks into the loan activities of informal lenders? Why would its task be quite difficult?

Question 4:

Why do you think that the share of formal sector credit is higher for the richer households compared to the poorer households?

Exercises

Question 1:

In situations with high risks, credit might create further problems for the borrower. Explain.

जोखिम वाली परिस्थितियों में ऋण कर्जदार के लिये और समस्याएँ खड़ी कर सकता है। स्पष्ट कीजिए।

Answer

When a borrower takes a loan in a high-risk situation (such as uncertain income, crop failure, or unstable business), there is a high chance that they may not be able to repay it on time. If the income from the borrowed money is less than expected or there is a complete loss, the borrower still has to repay the loan with interest.

This can lead to:

(1) Debt Trap – The borrower may take another loan to repay the first one, increasing the total debt.

(2) Loss of Property – If they fail to repay, lenders may seize land, house, or other assets.

(3) Social and Mental Stress – Non-repayment can lead to humiliation, harassment, and mental health issues.

जब कोई व्यक्ति जोखिमपूर्ण स्थिति में (जैसे – अनिश्चित आय, फसल की असफलता, अस्थिर व्यवसाय) ऋण लेता है, तो उसके समय पर चुकाने की संभावना कम हो जाती है। यदि ऋण से प्राप्त आय अपेक्षा से कम हो या पूरी तरह हानि हो जाए, तब भी उसे ब्याज सहित ऋण चुकाना पड़ता है।

इससे निम्न समस्याएँ उत्पन्न हो सकती हैं –

(1) ऋण जाल – पहला ऋण चुकाने के लिए नया ऋण लेना पड़ता है, जिससे कर्ज बढ़ता जाता है।

(2) संपत्ति की हानि – समय पर भुगतान न होने पर साहूकार या बैंक ज़मीन, मकान आदि जब्त कर सकते हैं।

(3) सामाजिक व मानसिक तनाव – कर्ज न चुका पाने पर अपमान, उत्पीड़न और मानसिक परेशानी हो सकती है।

Question 2:

How does money solve the problem of double coincidence of wants? Explain with an example of your own.

मुद्रा आवश्यकताओं के दोहरे संयोग की समस्या को किस तरह सुलझाती है? अपनी ओर से उदाहरण देकर समझाइए।

Answer

In the barter system, goods were exchanged directly for other goods. This required a double coincidence of wants, meaning both parties had to want what the other was offering at the same time. This was often difficult to achieve.

Money acts as a medium of exchange and removes this problem.

Example:

Suppose I am a farmer who grows wheat, and I want a mobile phone. In the barter system, I would have to find a mobile phone seller who needs wheat — which is very unlikely. But with money, I can sell my wheat in the market, get money, and then buy the mobile phone from any shop, even if the shopkeeper doesn’t need wheat.

वस्तु-विनिमय प्रणाली में वस्तुओं का आदान-प्रदान सीधे अन्य वस्तुओं के बदले होता था। इसके लिए आवश्यकताओं के दोहरे संयोग की आवश्यकता होती थी, अर्थात् दोनों पक्षों को एक-दूसरे की वस्तु की आवश्यकता एक ही समय पर होनी चाहिए। यह स्थिति अक्सर मुश्किल होती थी।

मुद्रा एक विनिमय माध्यम के रूप में इस समस्या को समाप्त करती है।

उदाहरण:

मान लीजिए मैं गेहूँ उगाने वाला किसान हूँ और मुझे मोबाइल फोन चाहिए। वस्तु-विनिमय में मुझे ऐसा मोबाइल विक्रेता खोजना होगा जिसे गेहूँ चाहिए — जो बहुत कठिन है। लेकिन मुद्रा के माध्यम से मैं बाजार में गेहूँ बेचकर पैसा प्राप्त कर सकता हूँ और फिर किसी भी मोबाइल दुकान से फोन खरीद सकता हूँ, चाहे दुकानदार को गेहूँ की ज़रूरत हो या न हो।

Question 3:

How do banks mediate between those who have surplus money and those who need money?

अतिरिक्त मुद्रा वाले लोगों और जरूरतमंद लोगों के बीच बैंक किस तरह मध्यस्थता करते हैं?

Answer

Banks accept deposits from people who have surplus money and pay them interest. They use a major portion of these deposits to give loans to those who need funds for various purposes. Banks charge a higher interest rate on loans than they pay on deposits, earning the difference.

बैंक अतिरिक्त धन वाले लोगों से जमा स्वीकार करते हैं और उन्हें ब्याज देते हैं। इन जमाओं का बड़ा हिस्सा वे जरूरतमंद लोगों को विभिन्न उद्देश्यों के लिए ऋण के रूप में देते हैं। बैंक ऋण पर जमा की तुलना में अधिक ब्याज लेते हैं और अंतर से लाभ कमाते हैं।

Question 4:

Look at a 10 rupee note. What is written on top? Can you explain this statement?

10 रुपये के नोट को देखिए। इसके ऊपर क्या लिखा है? क्या आप इस कथन की व्याख्या कर सकते हैं?

Answer

On the top of a ₹10 note, it is written: “Reserve Bank of India – Guaranteed by the Central Government – I promise to pay the bearer the sum of ten rupees.” This means the note is legal tender, and the RBI, backed by the government, guarantees its value in payments.

₹10 के नोट के ऊपर लिखा होता है: “भारतीय रिज़र्व बैंक – केंद्र सरकार द्वारा गारंटीकृत – मैं धारक को दस रुपये अदा करने का वचन देता हूँ।” इसका अर्थ है कि यह कानूनी मुद्रा है और इसकी कीमत का आश्वासन रिज़र्व बैंक व सरकार देती है।

Question 5:

Why do we need to expand formal sources of credit in India?

हमें भारत में ऋण के औपचारिक स्रोतों को बढ़ाने की क्यों जरूरत है?

Answer

We need to expand formal sources of credit in India to reduce dependence on informal lenders who charge high interest and exploit borrowers. Formal sources like banks and cooperatives provide loans at lower interest rates, with legal regulation, ensuring fair practices and promoting economic growth, especially for the poor.

भारत में औपचारिक ऋण स्रोतों को बढ़ाना जरूरी है ताकि लोग साहूकारों जैसे अनौपचारिक स्रोतों पर निर्भर न रहें, जो ऊँचा ब्याज लेकर शोषण करते हैं। बैंक व सहकारी संस्थाएँ कम ब्याज पर, कानूनी सुरक्षा के साथ ऋण देती हैं, जिससे गरीबों का विकास और आर्थिक वृद्धि संभव होती है।

Question 6:

What is the basic idea behind the SHGs for the poor? Explain in your own words.

गरीबों के लिए स्वयं सहायता समूहों के संगठनों के पीछे मूल विचार क्या है? अपने शब्दों में व्याख्या कीजिए।

Answer

The basic idea behind SHGs is to organize rural poor, especially women, into small groups of about 15–20 members. Members save regularly, and part of these savings is lent to members at reasonable interest rates. After a year or two, the group becomes eligible for bank loans. This system builds financial discipline, reduces dependence on moneylenders, and encourages self-reliance.

स्वयं सहायता समूहों (SHGs) का मूल विचार ग्रामीण गरीबों, विशेषकर महिलाओं, को 15–20 सदस्यों के छोटे समूहों में संगठित करना है। सदस्य नियमित बचत करते हैं और इसका कुछ हिस्सा सदस्यों को उचित ब्याज पर ऋण दिया जाता है। एक-दो वर्ष बाद समूह बैंक से ऋण पाने योग्य हो जाता है। यह व्यवस्था वित्तीय अनुशासन, आत्मनिर्भरता और साहूकारों पर निर्भरता को घटाती है।

Question 7:

What are the reasons why the banks might not be willing to lend to certain borrowers?

क्या कारण है कि बैंक कुछ कर्जदारों को कर्ज देने के लिए तैयार नहीं होते?

Answer

Banks may refuse loans to certain borrowers if they have no collateral, irregular or low income, poor credit history, or are engaged in high-risk activities. Banks want to ensure repayment, so they prefer borrowers who can provide security and have a stable source of income. Unreliable borrowers increase the risk of non-repayment, which banks try to avoid.

यदि किसी कर्जदार के पास जमानत न हो, आय अनियमित या कम हो, ऋण चुकाने का खराब इतिहास हो या वह उच्च-जोखिम वाले कार्य में संलग्न हो, तो बैंक उसे ऋण देने से मना कर सकते हैं। बैंक केवल उन्हीं को प्राथमिकता देते हैं जो सुरक्षा दे सकें और जिनकी आय स्थिर हो, ताकि ऋण न चुकाने का खतरा कम रहे।

Question 8:

In what ways does the Reserve Bank of India supervise the functioning of banks? Why is this necessary?

भारतीय रिजर्व बैंक अन्य बैंकों की गतिविधियों पर किस तरह नजर रखता है? यह जरूरी क्यों है?

Answer

The RBI supervises banks by ensuring they keep a minimum cash balance, monitoring loan activities, and checking that banks give loans to priority sectors like agriculture and small-scale industries. It also monitors interest rates. This is necessary to protect depositors’ money, ensure fair lending practices, and maintain stability and confidence in the financial system.

भारतीय रिज़र्व बैंक बैंकों को न्यूनतम नकद राशि रखने, ऋण देने की गतिविधियों की निगरानी करने और कृषि व लघु उद्योग जैसे प्राथमिक क्षेत्रों को ऋण देने की व्यवस्था सुनिश्चित करने के लिए निर्देश देता है। यह ब्याज दरों की भी निगरानी करता है। यह आवश्यक है ताकि जमाकर्ताओं के धन की सुरक्षा, निष्पक्ष ऋण व्यवस्था और वित्तीय स्थिरता बनी रहे।

Question 9:

Analyse the role of credit for development.

विकास में ऋण की भूमिका का विश्लेषण कीजिए।

Answer

Credit plays an important role in development when used productively. It helps farmers buy seeds and equipment, traders expand businesses, and industries set up production. Affordable credit increases income and employment, boosting economic growth. However, if taken in high-risk situations or at high interest rates, credit can lead to a debt trap, harming development instead.

जब ऋण का उपयोग उत्पादक कार्यों में होता है, तो यह विकास में महत्वपूर्ण भूमिका निभाता है। इससे किसान बीज व उपकरण खरीद सकते हैं, व्यापारी व्यवसाय बढ़ा सकते हैं और उद्योग उत्पादन स्थापित कर सकते हैं। सस्ता ऋण आय व रोजगार बढ़ाकर आर्थिक विकास को गति देता है। लेकिन उच्च जोखिम या ऊँचे ब्याज पर लिया गया ऋण ऋण-जाल में फँसाकर विकास को बाधित कर सकता है।

Question 10:

Manav needs a loan to set up a small business. On what basis will Manav decide whether to borrow from the bank or the moneylender? Discuss.

मानव को एक छोटा व्यवसाय करने के लिए ऋण की जरूरत है। मानव किस आधार पर यह निश्चित करेगा कि उसे यह ऋण बैंक से लेना चाहिए या साहूकार से? चर्चा कीजिए।

Answer

Manav will compare interest rates, repayment terms, and conditions. Banks offer lower interest and legal protection but require collateral, proper documents, and more time to process loans. Moneylenders give quick loans without much paperwork but at very high interest and with a risk of exploitation. If Manav has collateral and can wait, borrowing from a bank is safer and cheaper.

मानव ब्याज दर, पुनर्भुगतान की शर्तें और नियमों की तुलना करेगा। बैंक कम ब्याज और कानूनी सुरक्षा देते हैं, लेकिन जमानत, दस्तावेज़ और अधिक समय की आवश्यकता होती है। साहूकार जल्दी ऋण देते हैं और औपचारिकताएँ कम होती हैं, परंतु ब्याज बहुत ऊँचा और शोषण का खतरा रहता है। यदि मानव के पास जमानत है और वह इंतजार कर सकता है, तो बैंक से ऋण लेना सुरक्षित व सस्ता होगा।

Question 11:

In India, about 80 per cent of farmers are small farmers, who need credit for cultivation.

(a) Why might banks be unwilling to lend to small farmers?

(b) What are the other sources from which the small farmers can borrow?

(c) Explain with an example how the terms of credit can be unfavourable for the small farmer.

(d) Suggest some ways by which small farmers can get cheap credit.

भारत में 80 प्रतिशत किसान छोटे किसान हैं जिन्हें खेती करने के लिए ऋण की ज़रूरत होती है।

(क) बैंक छोटे किसानों को ऋण देने से क्यों हिचकिचा सकते हैं?

(ख) वे दूसरे स्रोत कौन-से हैं जिनसे छोटे किसान कर्ज ले सकते हैं?

(ग) उदाहरण देकर स्पष्ट कीजिए कि किस तरह ऋण की शर्ते छोटे किसानों के प्रतिकूल हो सकती हैं?

(घ) सुझाव दीजिए कि किस तरह छोटे किसानों को सस्ता ऋण उपलब्ध कराया जा सकता है।

Answer

(a) Banks may hesitate to lend to small farmers because they often lack collateral, have irregular income, and face high risk due to crop failure.

(क) बैंक छोटे किसानों को ऋण देने से इसलिए हिचकिचाते हैं क्योंकि उनके पास अक्सर जमानत नहीं होती, आय अनियमित होती है और फसल खराब होने का जोखिम अधिक होता है।

(b) Other sources include moneylenders, traders, relatives, friends, and cooperative societies.

(ख) अन्य स्रोत हैं – साहूकार, व्यापारी, रिश्तेदार, मित्र और सहकारी समितियाँ।

(c) Example – A moneylender may give ₹20,000 at 5% per month interest and demand repayment after harvest. If the crop fails, the farmer falls into a debt trap.

(ग) उदाहरण – साहूकार ₹20,000 का ऋण 5% मासिक ब्याज पर देकर फसल कटाई के बाद चुकाने की शर्त रख सकता है। फसल खराब होने पर किसान ऋण-जाल में फँस जाता है।

(d) Provide more rural bank branches, expand cooperatives, promote Self Help Groups (SHGs), and offer government-subsidized loans to farmers at low interest rates.

(घ) अधिक ग्रामीण बैंक शाखाएँ खोलना, सहकारी समितियों का विस्तार, स्वयं सहायता समूह (SHGs) को बढ़ावा देना और सरकार द्वारा किसानों को कम ब्याज पर सब्सिडी युक्त ऋण उपलब्ध कराना।

Question 12:

Fill in the blanks:

(i) Majority of the credit needs of the ___________households are met from informal sources.

(ii) ___________________costs of borrowing increase the debt-burden.

(iii) ____________ issues currency notes on behalf of the Central Government.

(iv) Banks charge a higher interest rate on loans than what they offer on _____.

(v) ______ is an asset that the borrower owns and uses as a guarantee until the loan is repaid to the lender.

रिक्त स्थानों की पूर्ति करें:

(क) ……. परिवारों की ऋण की अधिकांश ज़रूरतें अनौपचारिक स्रोतों से पूरी होती हैं।

(ख) ……….. ऋण को लागत ऋण का बोझ बढ़ाता है।

(ग) ……….. केंद्रीय सरकार की ओर से करेंसी नोट जारी करता है।

(घ) बैंक ……….. पर देने वाले ब्याज से ऋण पर अधिक ब्याज लेते हैं।

(ङ) ………… संपत्ति है जिसका मालिक कर्जदार होता है जिसे वह ऋण लेने के लिए गारंटी के रूप में इस्तेमाल करता है, जब तक ऋण चुकता नहीं हो जाता।

Answer

(क) ग़रीब

(ख) ऊँची

(ग) भारतीय रिज़र्व बैंक

(घ) जमा

(ङ) जमीन का टुकड़ा

Question 13:

Choose the most appropriate answer.

(i) In a SHG most of the decisions regarding savings and loan activities are taken by

(a) Bank.

(b) Members.

(c) Non-government organisation.

सही उत्तर का चयन करें:

(क) आत्मनिर्भर गुट में बचत और ऋण संबंधित अधिकतर निर्णय लेते हैं।

(a) बैंक

(b) सदस्य

(c) गैर-सरकारी संस्था

Answer

(b) Members

(ii) Formal sources of credit does not include

(a) Banks.

(b) Cooperatives.

(c) Employers.

(ख) ऋण के औपचारिक स्रोतों में शामिल नहीं है

(a) बैंक

(b) सहकारी समिति

(c) मालिक

Answer

(c) Employees