Important Questions of Class 12 Accountancy Ch-1 Fundamentals of Partnership

MCQ (1 Mark)

Question 1:

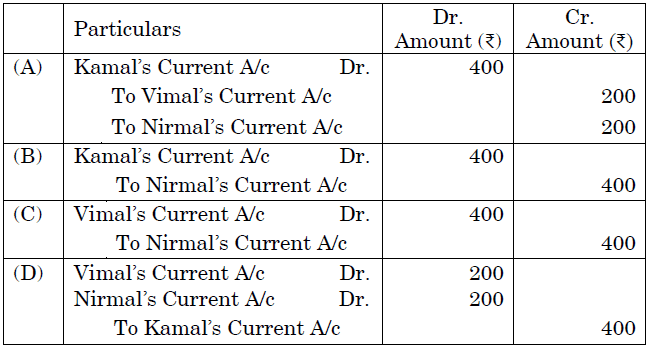

Kamal, Vimal and Nirmal are partners in a firm sharing profits and losses in the ratio of 5 : 3 : 2. Their fixed capitals were ₹ 3,00,000, ₹ 2,00,000 and ₹ 1,00,000 respectively. Interest on capital was credited to them @ 10% p.a. instead of 8% p.a. The Adjustment Entry to rectify the error will be :

Question 2:

Ranjeet and Ranvijay started a partnership firm on 1st April, 2023. According to the partnership deed, interest on drawings was to be charged @ 10% per annum. Ranjeet withdrew a fixed amount at the end of each month. The total yearly interest on Ranjeet’s drawings was ₹ 6,600. The amount of Ranjeet’s drawings for the year ended 31st March, 2024 was :

(A) ₹ 1,32,000 (B) ₹ 1,44,000 (C) ₹ 1,21,846 (D) ₹ 1,20,000

Question 3:

Mathur, Jain and Verma were partners in a firm sharing profits and losses in the ratio of 3 : 2 : 1. Jain was guaranteed that his share of profit will not be less than ₹ 80,000. The firm’s profit for the year ended 31st March, 2024 was ₹ 1,80,000. The amount of deficiency borne by Verma was :

(A) ₹ 15,000 (B) ₹ 5,000 (C) ₹ 20,000 (D) Nil

Question 4:

(A) Divya and Saurabh are partners in a firm. On 1st October, 2023, Saurabh advanced a loan of ₹ 5,00,000 to the firm. There is no partnership deed. On 31st March, 2024, Saurabh was entitled to get the following amount as interest on loan :

(A) ₹ 25,000 (B) ₹ 30,000 (C) ₹ 15,000 (D) Nil

(B) Sonia and Monu are partners in a firm. On 1st December, 2023, Monu advanced a loan of ₹ 3,00,000 to the firm. There is no partnership deed. On 31st March, 2024, Monu was entitled to get interest on loan amounting to :

(A) ₹ 18,000 (B) ₹ 4,500 (C) Nil (D) ₹ 6,000

(C) Ramesh and Jugesh are partners in a firm. On 1st July 2023, Jugesh advanced a loan of ₹ 2,00,000 to the firm. There is no partnership deed. On 31st March, 2024, Jugesh was entitled to get interest on loan amounting to :

(A) ₹ 12,000 (B) ₹ 9,000 (C) Nil (D) ₹ 20,000

Important Questions of Class 12 Accountancy Ch-1 Fundamentals of Partnership

Question 5: [2024C]

Nikhil and Sharat were partners in a firm sharing profits and losses in the ratio of 4:3. Nikhil withdrew ₹6,000 on the first day of every quarter for the year ended 31st March 2023. Interest on drawings is to be charged at 5% per annum. Interest on Nikhil’s drawings will be calculated for:

(A) 6 months (B) 4.5 months (C) 7.5 months (D) 3 months

Answer

(A) 6 months

Important Questions of Class 12 Accountancy Ch-1 Fundamentals of Partnership

Question 6: [2024C]

Read the following hypothetical situation and answer questions No. (1) and (2) based on the given information:

Daksh and Ekansh are partners in a firm sharing profits and losses in the ratio of 3:1. Their capitals were ₹1,60,000 and ₹1,00,000, respectively. As per the partnership deed, they were entitled to interest on capital at 10% p.a.. The firm earned a profit of ₹13,000 for the year ended 31st March 2023.

(1) Daksh’s interest on capital will be:

(A) ₹5,000 (B) ₹8,000 (C) ₹16,000 (D) ₹10,000

(2) Ekansh’s share of profit/loss will be:

(A) Nil (B) ₹9,750 (Loss) (C) ₹3,250 (Loss) (D) ₹9,750 (Profit)

Answer

(1) (B) ₹ 5,000; (2) (A) Nil

Important Questions of Class 12 Accountancy Ch-1 Fundamentals of Partnership

Question 7: [2024]

Abhay, Boris and Chetan were partners in a firm sharing profits in the ratio of 5 : 3 : 2. Boris was guaranteed a profit of ₹ 95,000. Any deficiency on account of this was to be borne by Abhay and Chetan equally. The firm earned a profit of ₹ 2,00,000 for the year ended 31st March, 2023. The amount given by Abhay to Boris as guaranteed amount will be :

(A) ₹ 17,500 (B) ₹ 35,000 (C) ₹ 25,000 (D) ₹ 10,000

Important Questions of Class 12 Accountancy Ch-1 Fundamentals of Partnership

Assertion -Reason (1 Mark)

Question 1:

There are two statements, Assertion (A) and Reason (R).

Assertion (A) : Under the fluctuating capital method, only one account, i.e., capital account is maintained for each partner.

Reason (R) : All the adjustments such as share of profit and loss, interest on capital, drawings, interest on drawings, salary or commission to partners, etc. are recorded directly in the capital accounts of the partners.

Choose the correct alternative from the following :

(A) Both Assertion (A) and Reason (R) are correct and Reason (R) is the correct explanation of Assertion (A).

(B) Both Assertion (A) and Reason (R) are correct, but Reason (R) is not the correct explanation of Assertion (A).

(C) Assertion (A) is correct, but Reason (R) is incorrect.

(D) Assertion (A) is incorrect, but Reason (R) is correct.

Question 2:[2024C]

There are two statements: Assertion (A) and Reason (R).

Assertion (A): The maximum number of partners in a partnership firm is 50.

Reason (R): The maximum number of partners are prescribed by the Partnership Act, 1932.

Choose the correct option from the following:

(A) Both Assertion (A) and Reason (R) are correct, but Reason (R) is not the correct explanation of Assertion (A).

(B) Both Assertion (A) and Reason (R) are correct, and Reason (R) is the correct explanation of Assertion (A).

(C) Assertion (A) is correct, but Reason (R) is incorrect.

(D) Assertion (A) is incorrect, but Reason (R) is correct.

Answer

(D) Assertion (A) is incorrect, but Reason (R) is correct.

Important Questions of Class 12 Accountancy Ch-1 Fundamentals of Partnership

3 Marks

Question 1: [2024C]

Jatin, Keshav, and Lalit were partners in a firm with fixed capitals of ₹ 1,20,000, ₹ 1,00,000, and ₹ 80,000, respectively. As per the partnership deed, there was a provision for allowing interest on capitals @ 10% p.a., but entries for the same had not been made for the last two years.

The profit-sharing ratio during the last two years was as follows:

| Year | Jatin | Keshav | Lalit |

|---|---|---|---|

| 2021 – 22 | 5 | 3 | 2 |

| 2022 – 23 | 1 | 1 | 1 |

Pass an adjustment entry at the beginning of the third year, i.e., on 1st April 2023.

Important Questions of Class 12 Accountancy Ch-1 Fundamentals of Partnership

Question 2: [2024C]

Meera, Neena, and Ojas were partners in a firm sharing profits and losses in the ratio of 5 : 3 : 2. The partnership deed provided for charging interest on drawings @ 10% p.a. The drawings of Meera, Neena, and Ojas during the year ended 31st March 2023 amounted to ₹ 60,000, ₹ 50,000, and ₹ 40,000, respectively. After the final accounts had been prepared, it was discovered that interest on drawings had not been taken into consideration.

Pass the necessary adjustment entry.

Answer

Important Questions of Class 12 Accountancy Ch-1 Fundamentals of Partnership

Question 3:

Answer

Comments are closed.