Solutions Dissolution of Partnership Firm TS Grewal Class 12 [2025-26]

Table of Contents

Journal Entries Questions 1 to 18

Question 1:

what Journal entry will be passed when the unrecorded furniture of ₹ 20,000 is taken by X a partner at ₹ 15,000 on the dissolution of the firm?

Solution

X’s Capital A/c Dr. \(\;\) 15,000

\(\quad\) To Realisation A/c\(\quad\) 15,000

(X taken over an unrercorded furniture of ₹ 20,000 for ₹ 15,000)

Question 2:

Land and Building (Book Value) ₹ 1,60,000 sold for ₹ 3,00,000 through a broker who charged 2% commission on the deal. Journalise the transaction, at the time of dissolution of the firm.

Solution

Bank A/c Dr. \(\;\) 2,94,000

\(\quad\) To Realisation A/c \(\quad\) 2,94,000

(Being Land and Building sold and 2% commission to a broker)

Question 3:

(a) Pass the Journal entry when an unrecorded liability of ₹ 15,000 is settled at ₹ 10,000 and paid by X, a partner on the dissolution of a firm?

Solution

Realisation A/c Dr. \(\;\) 10,000

\(\quad\) To X’s Capital A/c \(\quad\) 10,000

(Being unrecorded liability paid by partner, X)

(b) What Journal entry will be passed when a machine having a book value of ₹ 15,000 is given to Rakesh, a creditor of ₹ 22,000 at an agreed value of ₹ 12,000 towards part payment of his dues?

Solution

Realisation A/c Dr. \(\;\) 10,000

\(\quad\) To Bank A/c \(\quad\quad\quad\quad\) 10,000

(Being Balance of Rakesh paid in full settlement)

Question 4:

If a Loan from X, a partner, of ₹ 22,000 exists in the liabilities side of the Balance Sheet of the firm and X’s Capital Account has a debit balance of ₹ 2,000.

What Journal entry will you pass on payment of such a loan?

Solution

Loan A/c Dr. \(\;\) 22,000

\(\quad\) To X’s Capital A/c \(\quad\) 2,000

\(\quad\) To X Bank A/c \(\quad \quad\) 20,000

(Being unrecorded liability paid by partner, X)

Solutions Dissolution of Partnership Firm TS Grewal Class 12 [2025-26]

Question 5:

Pass Journal entries in the following cases?

(a) Expenses of realisation ₹ 600 to be borne by the firm and are paid by Mohan, a partner.

(b) Mohan, one of the partners of the firm, was asked to carry out dissolution of the firm for which he was allowed a salary of ₹ 20,000. Expenses for dissolution were ₹ 5,000.

(c) Motor car of book value ₹ 50,000 taken by a creditor of the book value of ₹ 40,000 in settlement.

Solution

(a) Realisation A/c Dr. 600

\(\quad\) To Mohan’s Capital A/c \(\quad\) 600

(Being realisation expenses paid by Mohan)

(b) Realisation A/c Dr. 25,000

\(\quad\) To Mohan’s Capital A/c \(\quad\) 20,000

\(\quad\) To Cash A/c \(\quad\quad\quad\quad\quad\) 5,000

(c) No entry

Question 6:

Pass Journal entries for the following:

(a) Realisation expenses of ₹ 10,000 were to be borne by Raman, a partner, but were paid by the firm.

(b) Mahesh, a partner, was paid remuneration of ₹ 25,000 and he was to meet all expenses.

(c) Suresh, a partner, was paid remuneration of ₹ 20,000 and he was to meet all expenses. Firm paid an expense of ₹ 5,000.

Solution

(a) Raman’s Capital A/c Dr. 10,000

\(\quad\) To Bank A/c \(\quad\quad\quad\quad \quad\) 10,000

(b) Realisation A/c Dr. 25,000

\(\quad\) To Mahesh’s Capital A/c \(\quad\) 25,000

(c) Realisation A/c Dr. 25,000

\(\quad\) To Suresh’s Capital A/c \(\quad\) 20,000

\(\quad\) To Bank A/c \(\quad\quad\quad\quad\quad\) 5,000

Question 7:

Pass Journal entries for the following:

(a) Firm agreed to pay Alok ₹ 7,500 towards dissolution expenses. Dissolution expenses were ₹ 10,000, which were paid by the firm.

(b) Realisation expenses were ₹ 5,000. it was agreed that the firm will bear ₹ 2,000 and balance by Ravi, a partner.

(c) Dissolution expenses of ₹ 10,000 were paid by Amit, a partner, on behalf of the firm.

(d) Realisation expenses up to ₹ 6,000 was agreed by the firm to reimburse Ajay. Dissolution Expenses were ₹ 7,000.

Solution

(a) Realisation A/c Dr. 5,000

\(\quad\) To Alok’s Capital A/c \(\quad\) 5,000

Alok’s Capital A/c Dr. 10,000

\(\quad\) To Bank A/c \(\quad\quad\quad\quad\) 10,000

(b) Realisation A/c Dr. 2,000

\(\quad\) Ravi’s capital A/c Dr. 3,000

\(\quad\) To Bank A/c \(\quad\quad\quad\) 5,000

(c) Realisation A/c Dr. 10,000

\(\quad\) To Amit’s Capital A/c \(\quad\) 10,000

(d) Realisation A/c Dr. 6,000

\(\quad\) To Ajay’s Capital A/c \(\quad\) 6,000

Question 8:

Pass necessary Journal entries in the following cases:

(a) Creditors of ₹ 85,000 accepted ₹ 40,000 as cash and investment of ₹ 43,000, in full settlement of their claim.

(b) Creditors were ₹ 16,000. They accepted Machinery valued at ₹ 18,000 in settlement of their claim.

(c) Creditors were ₹ 90,000. They accepted Building valued at ₹ 1,20,000 and paid cash to the firm ₹ 30,000.

Solution

(a) Realisation A/c Dr. 40,000

\(\quad\) To Cash A/c \(\quad\quad\) 40,000

(b) No Entry

(c) Cash A/c Dr. \(\quad\) 30,000

\(\quad\) To Realisation A/c \(\quad\quad\quad\) 30,000

Question 9:

Charu, Dhwani, Iknoor and Paavni were partners in a firm. They had entered into partnership firm last year only, through a verbal agreement. They contributed Capitals in the firm and to meet other financial requirement, few partners also provided loan to the firm. Within a year, their conflicts arisen due to certain disagreements and they decided to dissolve the firm. The firm had appointed Ms. Kavya, who is a financial advisor and legal consultant, to carry on the dissolution process. In the firm instance, Ms. kavya had transferred various assets and external liabilities to Realisation Account. Due to her busy schedule; Ms. Kavya has delegated this assignment to you, being an intern in her firm. On the date of dissolution, you have observed the following transactions:

(i) Dhwani’s Loan of ₹ 50,000 to the firm was settled by paying ₹ 42,000.

(ii) Paavni’s Loan of ₹ 40,000 was settled by giving an unrecorded asset of ₹ 45,000.

(iii) Loan to Charu of ₹ 60,000 was settled by payment to Charu’s brother loan of the same amount.

(iv) Iknoor’s Loan of ₹ 80,000 to the firm and she took over Machinery of ₹ 60,000 as part payment.

You are required to pass necessary entries for all the above-mentioned transactions.

Solution

(i) Dhwani’s Loan A/c Dr. 50,000

\(\quad\) To Bank A/c \(\quad\quad\quad\quad\quad\quad\quad\) 42,000

\(\quad\) To Realisation A/c \(\quad\quad\quad\quad\quad\) 8,000

(ii) Paavni’s Loan A/c Dr. \(\quad\) 40,000

\(\quad\) To Realisation A/c \(\quad \quad\quad \) 40,000

(iii) Realisation A/c Dr. 60,000

\(\quad\) To Charu’s Loan A/c \(\quad\) 60,000

(iv) Iknoor’s Loan A/c Dr. 80,000

\(\quad\) To Realisation A/c \(\quad\quad\) 60,000

\(\quad\) To Bank A/c \(\quad\quad\quad\quad\) 20,000

Question 10:

Pass, Journal entries for the following at the time of dissolution of the firm of X and Y after the various assets (other than cash) and outside liabilities have been transferred to Realisation Account:

(a) Sale of Assets – ₹ 50,000.

(b) Payment of Liabilities – ₹ 10,000.

(c) A commission of 5% allowed to X, a partner, on sale of assets.

(d) Realisation expenses were ₹ 15,000. The firm had agreed with X, to reimburse him ₹ 10,000.

(e) Employees Provident Fund ₹ 10,000.

(f) Z, a debtor, whose account of ₹ 6,000 was written off as bad earlier, paid 60% of the amount.

(g) Investment (Book Value ₹ 10,000) realised at 150%.

(h) Realisation expenses were ₹ 10,000. The firm had agreed with Krishan, a partner, to reimburse him up to ₹ 7,500.

Solution

Journal Entries

(a) Bank A/c Dr. \(\quad\) 50,000

\(\quad\) To Realisation A/c \(\quad\quad\quad\) 50,000

(Being assets sold for cash)

(b) Realisation A/c Dr. \(\quad\) 10,000

\(\quad\) To Bank A/c \(\quad\quad\quad\) 10,000

(Being liabilities are paid off)

(c) Realisation A/c Dr. \(\quad\) 2,500

\(\quad\) To X’s Capital A/c \(\quad\quad\) 2,500

(Being commision allowed to X)

(d) Realisation A/c Dr.\(\quad\) 10,000

\(\quad\) To X’s Capital A/c \(\quad\quad\) 10,000

(Being realisation expenses reimbursed)

(e) Realisation A/c Dr. \(\quad\) 10,000

\(\quad\) To Bank A/c \(\quad\quad\quad\) 10,000

(Being employees provident paid)

(f) Bank A/c Dr.\(\quad\) 3,600

\(\quad\) To Realisation A/c \(\quad\quad\quad\) 3,600

(g) Bank A/c Dr. \(\quad\) 15,000

\(\quad\) To Realisation A/c \(\quad\quad\quad\) 15,000

(Being investment sold)

(h) Realisation A/c Dr. \(\quad\) 7,500

\(\quad\) To Y’s Capital A/c \(\quad\quad\quad\) 7,500

(Being Realiation expneses reimbursed)

Question 11:

Pass necessary Journal entries for the following transactions, on the dissolution of a partnership firm of Kavita and Suman on 31st March, 2022, after the various assets (other than cash) and third party liabilities have been transferred to Realisation Account.

(a) Kavita took over stock amounting to ₹ 1,00,000 at ₹ 90,000.

(b) Creditors of ₹ 2,00,000 took over Plant and Machinery of ₹ 3,00,000 in full settlement of their claim.

(c) There was an unrecorded asset of ₹ 23,000 which was taken over by Suman at ₹ 17,000.

(d) Realisation expenses ₹ 2,000 were paid by Kavita.

(e) Bank Loan of ₹ 21,000 was paid off.

(f) Loss on dissolution amounted to ₹ 7,000.

Solution

Journal

(a) Kavita’s Capital A/c Dr. \(\quad\) ₹ 90,000

\(\quad\) To Realisation A/c \(\quad\quad\quad\quad\quad\) ₹90,000

(Being Kavita took over stock for ₹90,000 of ₹1,00,000)

(b) No Entry

(c) Suman’s Capital A/c Dr. \(\quad\) 17,000

\(\quad\) To Realisation A/c \(\quad\quad\quad\quad\) 17,000

(Being unrecorded assets taken over by Suman for ₹ 17,000 of ₹ 23,000)

(d) Realisation A/c Dr. \(\quad\) 2,000

\(\quad\) To Kavita’s Capital A/c \(\quad\quad\quad\quad\) 2,000

(Being Realisation expenses paid by Kavita)

(e) Realisation A/c Dr. \(\quad\) 21,000

\(\quad\) To Bank A/c Dr. \(\quad\quad\quad\quad\) 21,000

(Being bank loan paid off)

(f) Kavita’s Capital A/c Dr. \(\quad\) 3,500

\(\quad\) Suman’s Capital A/c Dr. \(\quad\) 3,500

\(\quad\) \(\quad\) To Realisation A/c \(\quad\quad\quad\quad\quad\) 7,000

Question 12:

Simar, Raja and Rita were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. The firm was dissolved on 31st March, 2019. After the transfer of assets (other than cash) and external liabilities to the Reaslisation Account, the following transactions took place:

(a) A debtor whose debt of ₹ 90,000 had been written off as bad, paid ₹ 88,000 in full settlement.

(b) Creditors to whom ₹ 1,21,000 were due to be paid, accepted stock at ₹ 71,000 and the balance was paid to them by a cheque.

(c) Raja had given a loan to the firm of ₹ 18,000. He was paid ₹ 17,000 in full settlement of his loan.

(d) Investments were ₹ 53,000 out of which investments of ₹ 43,000 were taken by Simar at ₹ 52,000 and the balance of the investments were sold for ₹ 12,000.

(e) Expenses on dissolution amounted to ₹ 19,000 and the same were paid by the firm.

(f) Profit on dissolution amounted to ₹ 30,000.

Pass the necessary Journal entries for the above transactions in the books of the firm.

Solution

Journal

(a) Bank A/c Dr. \(\quad\)88,000

\(\quad\) To Realisation A/c \(\quad\quad\quad\quad\) 88,000

(Being bad debts recovered)

(b) Realisation A/c Dr. \(\quad\) 50,000

\(\quad\) To Bank A/c \(\quad\quad\quad\quad\) 50,000

(Being creditors are paid in full settlement)

(c) Raja’s Loan A/c Dr. \(\quad\) 18,000

\(\quad\) To Bank A/c \(\quad\quad\quad\quad\) 17,000

\(\quad\) To Realisation A/c \(\quad\quad\quad\quad\) 1,000

(Being Rajan’s loan settled)

(d) Simar’s Capital A/c Dr. \(\quad\) 52,000

\(\quad\) Bank A/c Dr. \(\quad\quad\) 12,000

\(\quad\quad\) To Realisation A/c \(\quad\quad\quad\quad\quad\) 64,000

(Being invesment sold)

(e) Realisation A/c Dr. \(\quad\) 19,000

\(\quad\) To Bank A/c \(\quad\quad\quad\quad\) 19,000

(Being realisation expenses paid)

(f) Realisation A/c Dr. 30,000

\(\quad\) To Simar’s Capital A/c \(\quad\quad\quad\quad\) 12,000

\(\quad\) To Raja’s Capital A/c\(\quad\quad\quad\quad\) 12,000

\(\quad\) To Rita’s Capital A/c \(\quad\quad\quad\quad\) 6,000

Question 13:

Pass necessary Journal entries to record the following unrecorded assets and liabilities in the books of Paras and Priya.

(a) There was an old furniture in the firm which had been written off completely in the books. This was sold for ₹ 3,000.

(b) Ashish, an old customer whose account for ₹ 1,000 was written off as bad in the previous year, paid 60% of the amount.

(c) Paras agreed to takeover the firm’s goodwill (not recorded in the books of the firm), at a valuation of ₹ 30,000.

(d) There was an old typewriter which had been written off completely from the books. It was estimated to realise ₹ 400. It was taken by Priya at an estimated price less 25%.

(e) There was 100 shares of ₹ 100 each in Star Limited acquired at a cost of ₹ 2,000 which has been written off completely from the books. These share are valued @ ₹ 6 each and divided among the partners in their profit sharing ratio.

Solution:

Journal

(a) Bank A/c Dr. \(\quad\) 3,000

\(\quad\quad\) To Realisation A/c \(\quad\quad\) 3,000

(Being unreocrded furniture sold)

(b) Bank A/c Dr. \(\quad\) 600

\(\quad\quad\) To Realisation A/c \(\quad\quad\) 600

(Being bad debts recovered)

(c) Paras’Capital A/c Dr.\(\quad\) 30,000

\(\quad\quad\) To Realisation A/c \(\quad\quad\) 30,000

(Being goodwill taken over by Paras)

(d) Priya’s Capital A/c Dr. \(\quad\) 300

\(\quad\quad\) To Realisation A/c \(\quad\quad\) 300

(Being unrecorded typewriter taken over by Priya)

(e) Paras’ Capital A/c Dr. \(\quad\) 300

\(\quad\) Priya’s Capital A/c Dr. \(\quad\) 300

\(\quad\quad\) To Realisation A/c \(\quad\quad\) 600

Question 14:

Aman and Harsh were partners in a firm. They decided to dissolve their firm. Pass necessary Journal entries for the following after assets (other than Cash and Bank) and outside liabilities have been transferred to Realisation Account.

(a) There was furniture of ₹ 50,000. Aman took over 50% of the furniture at 10% discount.

(b) Profit & Loss Account was showing a credit balance of ₹ 15,000 on the date of dissolution.

(c) Harsh’s loan of ₹ 6,000 was settled by paying ₹ 5,500.

(d) The firm paid realisation expenses of ₹ 5,000 on behalf of Harsh, a partner.

(e) There was a bill for ₹ 1,200 under discount. The bill was received from Soham who became insolvent and a first and final dividend of 25% was received from his estate.

(f) Creditors, to whom the firm owed ₹ 6,000, accepted stock of ₹ 5,000 at a discount of 5% and the balance in cash.

Solution:

Journal

(a) Aman’s Capital A/c Dr. 22,500

\(\quad\) To Realisation A/c \(\quad\) 22,500

(Being 50% of the furniture taken over by Aman @ 10% discount.)

(b) Profit & Loss A/c Dr. 15,000

\(\quad\) To Aman’s Capital A/c \(\quad\) 7,500

\(\quad\) To Harsh’s Capital A/c \(\quad\) 7,500

(c) Harsh’s Loan A/c Dr. 6,000

\(\quad\) To Bank A/c \(\quad\) 5,500

\(\quad\) To Realisation A/c \(\quad\) 500

(d) Harsh’ Captial A/c Dr. 5,000

\(\quad\) To Bank A/c \(\quad\) 5,000

(Being realsiation expenses paid by the firm on behalf of Harsh.)

(e) Realisation A/c Dr. 900

\(\quad\) To Bank A/c \(\quad\) 900

(f) Realisation A/c Dr. 1,250

\(\quad\) To Bank A/c \(\quad\) 1,250

(6,000 – (5,000 – 25%))

Question 15:

Rohit, Kunal and Sarthak are partners in a firm. They decided to dissolve their firm. Pass necessary Journal entries for the following after various assets (other than Cash and Bank) and the third-party liability have been transferred to Realisation Account:

(a) kanal agreed to pay his wife’s loan of ₹ 60,000.

(b) Total Creditors of the firm were ₹ 40,000. Creditors of ₹ 10,000 were given a piece of furniture of book value ₹ 8,000 out of total furniture of book value ₹ 28,000 in settlement. Remaining Creditors allowed a discount of 1%.

(c) Rohit had given a loan of ₹ 70,000 to the firm which was duly paid.

(d) A machine which was not recorded in the books was taken by Kunal at ₹ 3,000, whereas its expected value was ₹ 5,000.

(e) The firm had a stock of ₹ 2,40,000, 25% of the stock was taken over by an unrecorded creditor of ₹ 70,000 in full settlement of his claim and the remaining stock was taken over by Rohit at 80% of cost.

(f) Sarthak paid the realisation expenses of ₹ 16,000 out of his private funds, who was to get a remuneration of ₹ 15,000 for completing dissolution process and was responsible to bear all the realisation.

Solution

Journal Entries

(a) Realisation A/c Dr. 60,000

\(\quad\) To Kunal’s Capital A/c \(\quad\) 60,000

(b) Realisation A/c Dr. 27,000

\(\quad\) To Bnk A/c \(\quad\) 27,000

(c) Rohit’s Capital A/c Dr. 70,000

\(\quad\) To Bank A/c \(\quad\) 68,000

\(\quad\) To Realisation A/c \(\quad\) 2,000

(d) Kunal’s Capital A/c Dr. 3,000

\(\quad\) To Realistion A/c \(\quad\quad\quad\) 3,000

(e)

(f) Realisation A/c Dr. 15,000

\(\quad\quad\) To Sarthak’s Capital A/c \(\quad\) 15,000

Question 16:

Pass necessary Journal entries for the following transactions on the dissolution of a firm after various assets (other than cash) and outside liabilities have been transferred to Realisation Account:

(i) Realisation expenses of the firm amounting to ₹ 2,600 were paid by partner, Aman.

(ii) A creditor of ₹ 4,500 took over stock valued at ₹ 5,200 in full settlement.

(iii) An unrecorded asset realised ₹ 3,500.

(iv) Remaining creditors amounting to ₹ 20,000 were paid at a discount of 5%.

(v) Remaining stock of ₹ 30,000 was taken over by Bimal, a partner, at a discount of 20%.

(vi) Investment whose face value was ₹ 10,000 was realised at 40%.

Solution

(i) Realisation A/c Dr. 2,600

\(\quad\quad\) To Aman’s Capital A/c \(\quad\quad\quad\quad\quad\) 2,600

(ii) No Entry

(iii) Cash/Bank A/c Dr. 3,500

\(\quad\quad\) Realisation A/c\(\quad\quad\) 3,500

(unrecorded assets realised)

(iv) Realisation A/c Dr. 19,000

\(\quad\quad\) To Bank A/c \(\quad\quad\) 19,000

(20,000 – 5%)

(v) Bimal’s Capital A/c Dr. 24,000

\(\quad\quad\) To Realisation A/c \(\quad\quad\) 24,000

(Bimal took over remaining stock @ 20% discount)

(vi) Bank A/c Dr. 4,,000

\(\quad\quad\) To Realisation A/c \(\quad\quad\) 4,000

(investment realised @ 40%)

Question 17:

Pass the necessary Journal entries for the following transactions on the dissolution of the partnership firm of Tina and Rina after the various assets (other than cash and bank) and external liabiliteis have been transferred to Realisation Account:

(i) There was an outstanding bill for repairs for which ₹ 20,000 were paid.

(ii) The firm had stock of ₹ 80,000. Tina took over 50% of the stock at a discount of 20% while the remaining stock was sold off for ₹ 52,000.

(iii) The firm had 100 shares of ₹ 10 each which were taken over by the partners at market value of ₹ 20 per share in their profit-sharing ratio of 3 : 2.

(iv) Realisation expneses of ₹ 4,000 were paid by Rina.

(v) Tina had given a loan of ₹ 40,000 to the firm which was duly paid.

(vi) Rina agreed to pay off her husband’s loan of ₹ 10,000 at a discount of 10%.

Solution

Journal

(i) Realisation A/c Dr. 20,000

\(\quad\quad\) To Bank A/c \(\quad\quad\) 20,000

(outstanding bill for repairs paid)

(ii) Tina’s Capital A/c Dr. 32,000

\(\quad\) Bank A/c Dr. 52,000

\(\quad\quad\) To Realisation A/c \(\quad\quad\) 84,000

(Half of stock taken over by Tina at 20% discount and rest is sold)

(iii) Tina’s Capital A/c Dr. 1,200

\(\quad\) Rina’s Capital A/c Dr. 800

\(\quad\quad\) To Realisation A/c \(\quad\quad\) 2,000

(100 shares @ 20 per share taken over by partners in 3 : 2)

(iv) Realisation A/c Dr. 4,000

\(\quad\quad\) To Rina’s Capital A/c \(\quad\quad\) 4,000

(Realisation expenses paid by Rina)

(v) Loan by Tina A/c Dr. 40,000

\(\quad\quad\) To Bank A/c \(\quad\quad\) 40,000

(Loan by Tina was duly paid)

(vi) Realisation A/c Dr. 9,000

\(\quad\quad\) To Rina’s Capital A/c 9,000

(Rina paid off her husband’s loan on behalf of the firm)

Question 18:

Pass necessary Journal entries on the dissolution of a firm in the following cases:

(a) Dharam, a partner, was appointed to look after the process of dissolution at a remuneration of ₹ 12,000 and he had to bear the dissolution expenses. Dissolution expenses ₹ 11,000 were paid by Dharam.

(b) Jay, a partner, was appointed to look after the process of dissolution and was allowed a remuneration of ₹ 15,000. Jay agreed to bear dissolution expenses. Actual dissolution expenses ₹ 16,000 were paid by Vijay, another partner on behalf of Jay.

(c) Deepa, a partner, was to look after the process of dissolution and for this work she was allowed a remuneration of ₹ 7,000. Deepa agreed to bear dissolution expenses. Actual dissolution expenses ₹ 6,000 were paid from the firm’s bank account.

(d) Dev, a partner, a agreed to do the work of dissolution for ₹ 7,500. He took away stock of the same amount as his commission. The stock had already been transferred to Realisation Account.

(e) Jeev, a partner, agreed to do the work of dissolution for which he was allowed a commission of ₹ 10,000. He agreed to bear the dissolution expenses. Actual dissolution expenses paid by Jeev were ₹ 12,000. These expenses were paid by Jeev by drawing cash from the firm.

(f) A debtor of ₹ 8,000 already transferred to Realisation Account agreed to pay the realisation expensesw of ₹ 7,800 in full settlement of his account.

Solution

Journal

(a) Realisation A/c Dr. 12,000

\(\quad\) To Dharam’s Capital A/c \(\quad\) 12,000

(b) Realisation A/c Dr. 15,000

\(\quad\) To Jay’s Capital A/c \(\quad\quad\) 15,000

\(\quad\)Jay’s Capial A/c Dr. 16000

\(\quad\quad\)To Vijay’s Capital A/c \(\quad\) 16,000

(c) Realisation A/c Dr. 7,000

\(\quad\) To Deepa’s Capital A/c \(\quad\quad\) 7,000

\(\quad\) Deepa’s Capital A/c Dr. 15,000

\(\quad\quad\) To Bank A/c \(\quad\quad\quad\quad\quad\) 15,000

(d) No Entry

(e) Realisation A/c Dr. 10,000

\(\quad\) To Jeev’s Capital A/c \(\quad\quad\) 10,000

\(\quad\) Jeev’s Capital A/c Dr. 12,000

\(\quad\quad\) To Cash A/c \(\quad\quad\quad\quad\quad\) 12,000

(f) No Entry

Question 19:

C, D and E were partners in a firm sharing profits in the ratio of 3 : 1 :

Their Balance Sheet as at 31st March, 2022 was as follows:

Balance sheet of C, D and E as at 31st March, 2022

| Liabilities | ₹ | Assets | ₹ |

| Capital A/css: C D E C’s Loan Sundry Creditors Bills Payable | 4,00,000 2,00,000 1,00,000 1,20,000 1,00,000 2,00,000 | Machinery Investments Stock Debtors Cash at Bank | 3,20,000 3,00,000 2,00,000 1,00,000 2,00,000 |

| 11,20,000 | 11,20,000 |

On the above date, the firm was dissolved due to certain disagreement among the partners.

(i) Machinery of ₹ 3,00,000 were given to creditors in full settlement of their account and remaining machinery was sold for ₹ 10,000.

(ii) Investments realised ₹ 2,90,000.

(iii) Stock was sold for ₹ 1,80,000.

(iv) Debtors for ₹ 20,000 proved bad.

(v) Realisation expenses amounted to ₹ 10,000.

Prepare Realisation Account.

Solution

Realisation Account

![Solutions Dissolution of Partnership Firm TS Grewal Class 12 1 Solutions Dissolution of Partnership Firm TS Grewal Class 12 [2025-26]](https://arorasir.com/wp-content/uploads/2025/06/image-1.png)

Question 20:

Ramesh and Umesh were partners in a firm sharing profits in the ratio of their capitals. On 31st March, 2023, their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors Workmen Compensation Reserve General Reserve Ramesh’s Current A/c Capital A/css: Ramesh Umesh | 1,70,000 2,10,000 2,00,000 80,000 7,00,000 3,00,000 | Bank Debtors Stock Furniture Machinery Umesh’s Capital | 1,10,000 2,40,000 1,30,000 2,00,000 9,30,000 50,000 |

| 16,60,000 | 16,60,000 |

On the above date the firm was dissolved:

(a) Ramesh took 50% of stock at ₹ 10,000 less than book value.

(b) Furniture was taken by Umesh for ₹ 50,000 and machinery was sold for ₹ 4,50,000.

(c) Creditors were paid in full..

(d) There was an unrecorded bill for repairs for ₹ 1,60,000 which was settled and paid at ₹ 1,40,000.

Prepare Realisation Account.

Solution

Realisation Account

![Solutions Dissolution of Partnership Firm TS Grewal Class 12 2 Solutions Dissolution of Partnership Firm TS Grewal Class 12 [2025-26]](https://arorasir.com/wp-content/uploads/2025/06/image.png)

Question 21:

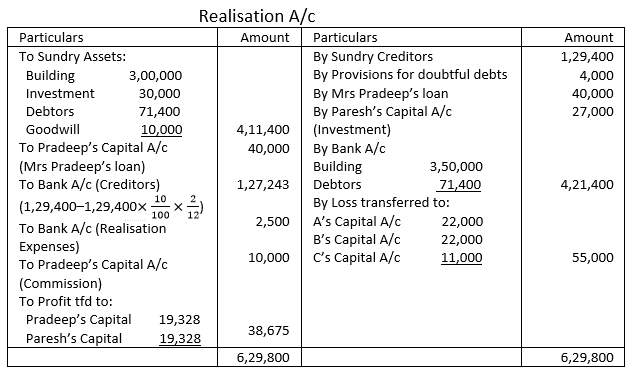

Pradeep and Paresh partners in a firm decided to dissolve their partnership firm on 1st April, 2024. Pradeep was deputed to realise the assets and to pay off the liabilities. He was paid ₹ 10,000 as commission for his services. Balance Sheet of the firm on 31st March, 2024 was as follows:

Balance Sheet as at 31st March, 2024

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

| Sundry Creditors Mrs. Pradeep’s Loan Paresh’s Loan Investment Fluctuation Reserve Capital A/cs: Pradeep Paresh | 1,29,400 40,000 24,000 8,000 1,21,000 1,21,000 | Building Investment Debtors \(\quad\quad\quad\quad\)71,400 Less: Provision for Doubtful Debts 4,000 Bank Profit & Loss A/c Goodwill | 3,00,000 30,000 67,400 16,000 20,000 10,000 |

| 4,43,400 | 4,43,400 |

Following terms and conditions were agreed upon:

(a) Pradeep agreed to pay his wife’s loan.

(b) Investment was given to Paresh for ₹ 27,000.

(c) Building realised ₹ 3,50,000.

(d) Creditors were to be paid after two months, they were paid immediately at 10% p.a. discount.

(e) Realisation expenses were ₹ 2,500.

Prepare Realisation Account.

Solution

Question 22:

Ashish and Kanav were partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2018 their Balance Sheet was as follows:

Balance Sheet as at 31st March, 2024

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

| Trade Creditors Employee’s Provident Fund Mrs Ashish’s Loan Kanav’s Loan Workmen’s Compensation Fund Investment Fluctuation Resere Capitals: Ashish Kanav | 42,000 60,000 9,000 35,000 20,000 4,000 2,00,000 | Bank Stock Debtors Furniture Plant Investments Profit & Loss A/c | 35,000 24,000 19,000 40,000 2,10,000 32,000 10,000 |

| 3,70,000 | 3,70,000 |

On the above date they decided to dissolve the firm:

(a) Ashish agreed to take over furniture at ₹ 38,000 and pay Mrs Ashish’s loan.

(b) Debtors realised ₹ 18,500 and plant realised 10% more.

(c) Kanav took over 40% of the stock at 20% less than the book value. Remaining stock was sold at a gain of 10%.

(d) Trade creditors took over investments in full settlement.

(e) Kavan agreed to take over the responsibility of completing dissolution at an agreed remuneration of ₹ 12,000 and to bear realisation expneses. Actual expenses of realisation amounted to ₹ 8,000.

Prepare Realisation Account.

Question 23:

A, B and C were partners sharing profits and losses in the ratio of 2 : 2 : 1. Their Balance sheet as at 31st March, 2018 was as follows:

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

| Capitals : A 7,50,000 B 3,00,000 C 2,50,000 Credtitors | 13,00,000 2,00,000 | Cash at Bank Sundry Debtors 1,95,000 Less: Provsions for Bad Debts 5,000 Stock Fixed Assets | 3,00,000 |

| 15,00,000 |

Question 24:

Mala, Neela and Kala were in partnership sharing profits in the ratio of 7 : 2 : 1 and the Balance Sheet of the firm as at 31st March, 2023 was:

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

Question 25:

Mike and Ajay are partners sharing profits and losses in ratio of the capitals. They decided to dissolve their firm on 31st March, 2022, the date on which the Balance Sheet stood as under:

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

Question 26:

Bale and Yale are equal partners of a firm. They decide to dissolve their partnership on 31st March, 2023 at which date their Balance sheet stood as:

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

Question 27:

Shilpa, Meena and Nanda decided to dissolve their partnership on 31st March, 2023. Their Profit sharing ratio was 3 : 2 : 1 and their Balance Sheet was as under:

Balance Sheet of Shilpa, Meena and Nanda as on 31st March, 2023

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

| Capital A/cs: Shilpa Meena Bank Loan Creditors Provision for Doubtful Debts General Reserve | 80,000 40,000 20,000 37,000 1,200 12,000 | Land Stock Debtors Nanda’s Capital Cash | 81,000 56,760 18,600 23,000 10,840 |

| 1,90,200 | 1,90,200 |

It is agreed as follows:

The stock of value of ₹ 41,660 are taken over by Shilpa for ₹ 35,000 and she agreeed to pay bank loan. The remaining stock was sold at ₹ 14,000 and debtors amounting to ₹ 10,000 realised ₹ 8,000. Land is sold for ₹ 1,10,000. The remaining debtors realised 50% at their book value. Cost of realisation amounted to ₹ 1,200. There was a typewriter not recorded in the books worth of ₹ 6,000 which were taken over by one of the Creditors at this value. Prepare Realisation Account, Partner’s Capital Accounts and Cash Account to close the books of the firm.

Question 28:

A and B are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March 2023, their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

Question 29:

Balance Sheet of P, Q and R as at 31st March, 2023, who were sharing profits in the ratio of 5 : 3 : 1 was:

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

Question 30:

Ashu and Harish are partners sharing profit and losses as 3 : 2. They decided to dissolve the firm on 31st March 2023. Their Balance sheet on the above date was:

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

Question 31:

A, B and C were equal partners. On 31st March, 2024, their Balance Sheet stood as:

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

Question 32:

Michael, Jackson and John are in partnership sharing profits and losses in the proportion of 1/2, 1/3 and 1/6 respectively. On 31st March, 2023, they decide to dissolve the partnership and the position of the firm on this date is represented by the following Balance Sheet:

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

Question 33:

Prashant and Rajesh are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2023, their Balance Sheet was:

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

Question 34:

Yogesh and Naresh were partners sharing profits equally. They dissolved the firm on 1st April, 2023. Naresh was assigned the responsibility to realise the assets and pay the liabilities at a remuneration of ₹ 10,000 including expenses. Balance Sheet of the firm as on that date was as follows:

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

Question 35:

Ashok, Babu and Chetan are in partnership sharing profit in the proportion of 1/2, 1/3, 1/6 respectively. They dissolve the partnership on 31st March, 2023 when the Balance Sheet of the firm is as under:

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

Question 36:

Rita and Sobha are partners in a firm, Fancy Garments Exports, sharing profits and losses equally. On 1st April, 2023, the Balance sheet of the firm was:

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

Question 37:

Arnab, Ragini and Dhrupad are partners sharing profits in the ratio of 3 : 1 : 1. Last year, conflicts arose due to certain issues of disagreements and on 31st March, 2023, they decided to dissolved the firm. On that date their Balance sheet was as under:

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

Question 38:

Raina and Meenu were partners in a firm which they dissolved on 31st March, 2023. On this date, Balance Sheet of the firm, apart from realisable assets and outside liabilities showed the following:

| Raina’s Capital | 40,000 (Cr.) |

| Meena’s Capital | 20,000 (Dr.) |

| Profit & Loss Account | 10,000 (Dr.) |

| Raina’s Loan to the Firm | 15,000 |

| General Reserve | 7,000 |

On the date of dissolution of the firm:

(a) Raina’s loan was repaid by the firm along with interest of ₹ 500.

(b) Dissolution expenses of ₹ 1,000 were paid by the firm on behalf of Raina.

(c) An unrecorded asset of ₹ 2,000 was taken by Meena while Raina paid an unrecorded liability of ₹ 3,000.

(d) Dissolution resulted in a loss of ₹ 60,000 from the realisation of assets and settlement of liabilities.

You are required to prepare Partner’s Capital Accounts.

Question 39:

There are two partners Angad and Raman in a firm and their capitals are ₹ 50,000 and ₹ 40,000. The creditors are ₹ 30,000. The assets of the firm realise ₹ 1,00,000. How much will Angad and Raman receive?

Question 40:

A, B and C were partners sharing profits in the ratio of 5 : 3 : 2. On 31st March, 2023, A’s Capital and B’s Capital were ₹ 30,000 and ₹ 20,000 respectively but C owed ₹ 5,000 to the firm. The liabilities were ₹ 20,000. The assets of the firm realised ₹ 50,000. Prepare Realisation Account, Partner’s Capital Accounts and Bank Account.

Question 41:

A and B were partners sharing profits and losses as to 7/11th to A and 4/11th to B. They dissolved the partnership on 30th May, 2022. As on that date their capitals were: A ₹ 7,000 and B ₹ 4,000. There were also due on Loan A/c to A ₹ 4,500 and to B ₹ 750. The other liabilities amounted to ₹ 5,000. The assets proved to have been undervalued in the last Balance Sheet and actually realised ₹ 24,000. Prepare necessary accounts showing the final settlement between partners.

Question 42:

Ramu, Laxman and Bharat started business on 1st April, 2024 with capitals of ₹ 1,00,000, ₹ 80,000 and ₹ 60,000 respectively sharing profits and losses in the ratio of 4 : 3 : 3. For the year ending 31st March, 2025, the firm incurred loss of ₹ 50,000. Each of the partners withdrew ₹ 10,000 during the year.

On 1st April, 2025, the firm was dissolved. Creditors of the firm stood at ₹ 24,000 on that date and cash in hand was ₹ 4,000. Assets realised ₹ 3,00,000 and creditors were paid ₹ 23,500 in settlement of their claims.

Prepare Realisation Account and show your working clearly.

Question 43:

A, B and C started business on 1st April, 2022 with capitals of ₹ 1,00,000; ₹ 80,000 and ₹ 60,000 respectively sharing profits (losses) in the ratio of 4 : 3 : 3. For the year ended 31st March, 2023, firm incurred loss of ₹ 50,000. Each of the partners withdrew ₹ 10,000 during the year. On 31st March, 2023, the firm was dissolved, the creditors of the firm stood at ₹ 24,000 on that date and Cash in Hand was ₹ 4,000. The assets realised ₹ 3,00,000 and Creditors were paid ₹ 23,500 in full settlement of their claims. Prepare Realisation Account and show your workings clearly.

Question 44:

Priya, Komal and Rakhi were in partnership sharing profits and losses in the ratio of 2 : 1 : 1. They decided to dissolve the partnership. On that date of dissolution, Sundry Assets (including cash ₹ 5,000) amounted to ₹ 88,000, assets realised ₹ 80,000 (including an unrecorded asset which realised ₹ 4,000). A contingent liability on account of bills discounted ₹ 8,000 was paid by the firm. The Capital Accounts of Priya, Komal and Rakhi showed a balance of ₹ 20,000 each. Prepare Realisation Account, Partner’s Capital Accounts and Cash Account.

Question 45:

The partnership between A and B was dissolved on 31st March, 2023. On that date the respective credits to the capitals were A – ₹ 1,70,000 and B – ₹ 30,000. ₹ 20,000 were owed by B to the firm; ₹ 1,00,000 were owed by the firm to A and ₹ 2,00,000 were due to the Trade Creditors. Profits and losses were shared in the proportions of 2/3 to A, 1/3 to B. The assets represented by the above stated net liabilities realised ₹ 4,50,000 exclusive of ₹ 20,000 owed by B. The liabilities were settled at book figures. Prepare Realisation Account, Partner’s Capital Accounts and Cash Account showing the distribution to the partners.

Question 46:

X and Y were partners sharing profits and losses in the ratio of 3 : 2. They decided to dissolve the firm on 31st March 2023. On that date, their Capitals were X – ₹ 40,000 and Y – ₹ 30,000. Creditors amounted to ₹ 24,000. Assets were realised for ₹ 88,500. Creditors of ₹ 16,000 were taken over by X at ₹ 14,000. Remaining Creditors were paid at ₹ 7,500. The cost of realisation came to ₹ 500. Prepare necessary accounts.

Question 47:

P, Q and R are partners sharing profits and losses in the ratio of 3 : 3 : 2. Their respective capitals are in their profit-sharing proportions. On 1st April, 2022, the total capital of the firm and balance of General Reserve are ₹ 80,00 and ₹ 20,000 respectivel. During the year 2022 – 23, the firm earned profit of ₹ 28,000 before charging interest on capital @ 5%. The drawings of the partners are P – ₹ 8,000; Q – ₹ 7,000; and R – ₹ 5,000. On 31st March, 2023, their liabilities were ₹ 18,000. On this date, they decided to dissolve the firm. The assets realised ₹ 1,08,600 and realisation expenses amounted to ₹ 1,800.

Prepare necessary Ledger Accounts to close the books of the firm.